July 2022

July is undoubtedly a time to celebrate our nations independence, but also a time to reflect on the importance of being surrounded by family and friends who make you the best version of yourself. So as you fire up your barbeque, chill down your favorite beverage and plan to enjoy the great outdoors, we invite you to read the July edition of the Hilltop e-newsletter Your Wealth Connection. We trust you will find the information useful and hope you can learn a bit more about what is new here at Hilltop.

We encourage you to visit our website, HilltopWealthTax.com, to learn more about our services, our team and upcoming events for clients and friends.

The Hilltop Ice Cream Social – July 20, 2022

• Mark your calendar for this family friendly annual event!

Hilltop KIDS

• Learn more about our new charitable fund and how you can get involved.

Informative

• Major Risks to Family Wealth

• Rehearsing for Retirement

Market Update

• Information about the Capital Markets and what is going on with our current economic conditions.

SPOTLIGHT!

• Introducing Hilltop’s Newest Team Member – Ira the Hedgehog!

Refer-a-Friend

• The greatest compliment we can receive is your referral.

July Trivia

As always, we are honored and humbled that you have given us the opportunity to serve as your financial advisor.

From the entire Hilltop team, we hope you enjoy the information!

Erik W. Brenner CFP® NSSA®

CEO, President and Private Wealth Advisor

Allow us the opportunity to build you a custom Retirement Roadmap and we’ll send you a $100 Gas Card.

ICE CREAM SOCIAL

Wednesday – July 20th

4pm – 7pm

We invite you to an Ice Cream Social in the Hilltop Wealth parking lot. We’ll have ice cream from The Chief Creamery of Granger, the American Espresso coffee cart, cotton candy cart, face painting, balloon artist, games, and a dunk tank fundraiser!

Kids and grandkids are highly encouraged to attend.

Dunk the Hilltop team! All proceeds benefit Hilltop Kids, providing direct assistance to schools and families in need in our communities.

1 ball for $5 3 balls for $10 Push the button for $50

WHO IS IN THE HOT SEAT?

4:00-Tareq Jallaf, Investment Operations Associate

4:30- Shaun Fedder, Director of Operations

5:00- Cliff Hawkins, Private Wealth Advisor

5:30- Matt Aurenz, Private Wealth Advisor

6:00- Bill Davis, Private Wealth Advisor

6:30- Erik Brenner, CEO and President

Questions? Contact Marla by email or call 574-889-7526

What began as a conversation about how the Hilltop team can best give back to the communities where we live and work quickly gained traction and we are very excited to announce the launching of Hilltop KIDS! This charitable entity is incorporated in the State of Indiana and has received full exempt status from the IRS as a registered 501(c)(3). We formally launched the fund at the South Bend Cubs Rooftop event and were thrilled by the positive reception from all the guests.

The primary focus will be to assist at-risk children and their families and we envision the fund will be a used to provide both direct support to those in need and partner agencies that share similar visions, missions and passions.

Hilltop KIDS will also be an avenue where Hilltop team members can provide financial literacy to those who are often targets of predatory lending, get buried by high interest rate credit card debt or need assistance with constructing and adhering to a sound budget.

There will be many exciting opportunities on the horizon for Hilltop KIDS, including the establishment of a scholarship. Please reach out to our offices if you are interested in learning more!

INFORMATIVE

Major Risks to Family Wealth

Protect your family assets for future generations.

Provided by Hilltop Wealth & Tax Solutions

All too often, family wealth fails to last. One generation builds a business—or even a fortune— lost in the ensuing decades. Why does it happen, again and again?

Often, families fall prey to serious money blunders, making classic mistakes, or not recognizing changing times.

This article is for informational purposes only and is not a replacement for real-life advice. Make sure to consult legal and tax professionals before modifying your overall estate strategy.

Procrastination. This is not just a matter of failing to create a strategy but also failing to respond to acknowledged financial weaknesses.

As a hypothetical example, say there is a multimillionaire named Alan. The designated beneficiary of Alan’s six-figure savings account is no longer alive. He realizes he should name another beneficiary, but he never gets around to it. His schedule is busy, and updating that beneficiary form is inconvenient. Alan forgets about it and moves on with his life.

However, this can cause significant headaches for those left behind. If the account lacks a payable-on-death (POD) beneficiary, those assets may end up subject to probate. Using our example above, Alan’s heirs may discover other lingering financial matters that required attention regarding his retirement accounts, real estate holdings, and other investment accounts.1

Minimal or absent estate management. Every year, some multimillionaires die without leaving any instructions for distributing their wealth. These people are not just rock stars and actors but also small business owners and entrepreneurs. According to a recent Caring.com survey, 58% of Americans have no estate preparations in place, not even a will.2

Anyone reliant on a will alone may risk handing the destiny of their wealth over to a probate judge. The multimillionaire who has a child with special needs, a family history of Alzheimer’s or Parkinson’s, or a former spouse or estranged children may need a greater degree of estate management. If they want to endow charities or give grandkids an excellent start in life, the same idea applies. Business ownership calls for coordinated estate management with consideration for business succession.

A finely crafted estate strategy has the potential to perpetuate and enhance family wealth for decades, and perhaps, generations. Without it, heirs may have to deal with probate and a painful opportunity cost—the lost potential for tax-advantaged growth and compounding of those assets.

The lack of a “family office.” Decades ago, the wealthiest American households included offices: a staff of handpicked financial professionals who supervised a family’s entire financial life. While traditional “family offices” have disappeared, the concept is as relevant as ever. Today, select wealth management firms emulate this model: in an ongoing relationship distinguished by personal and responsive service, they consult families about investments, provide reports, and assist in decision-making. If your financial picture has become far too complex to address on your own, this could be a wise choice for your family.

Technological flaws. Hackers can hijack email and social media accounts and send phony messages to banks, brokerages, and financial professionals to authorize asset transfers. Social media can help you build your business, but it can also expose you to identity thieves seeking to steal both digital and tangible assets.

Sometimes a business or family installs a security system that proves problematic—so much so that it’s silenced half the time. Unscrupulous people have ways of learning about that, and they may be only one or two degrees separated from you.

No long-term strategy in place. When a family wants to sustain wealth for decades to come, heirs will want to understand the how and why, and be on the same page. If family communication about wealth tends to be more opaque than transparent, then that communication may adequately explain the mechanics and purpose of the strategy.

No decision-making process. In some high net worth families, financial decision-making is vertical and top-down. Parents or grandparents may make decisions in private, and it may be years before heirs learn about those decisions or fully understand them. When heirs do become decision-makers, it is usually upon the death of the elders.

Horizontal decision-making can help multiple generations commit to the guidance of family wealth. Financial professionals can help a family make these decisions with an awareness of different communication styles. In-depth conversations are essential; good estate managers recognize that silence does not necessarily mean agreement.

You may attempt to reduce these risks to family wealth (and others) in collaboration with financial and legal professionals. It is never too early to begin.

Erik Brenner, CFP® may be reached at 574.889.7526 or visit our website at www.HilltopWealthTax.com.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

This presentation is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Hilltop Wealth Solutions to be reliable.

Additional information about Hilltop Wealth Solutions is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary Report which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC # 801-115255. Hilltop Wealth Solutions is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Citations

- SmartCapitalMind.com, February 4, 2022

- Yahoo.com, January 18, 2022

Rehearsing for Retirement

Try living as a “retiree” for a month or two before you commit to leaving your career.

Provided by Hilltop Wealth & Tax Solutions

Imagine if you could preview your retirement in advance. In a sense, you can. Financially and mentally, you can “rehearse” for the third act of your life, while still enjoying the second.

Pretend you are retired for a month or two. Take two steps to act out your rehearsal – one having to do with your budget, the other with your expectations.

Draw up a retirement budget & live on it for one, two, or three months. Make a list of essential expenses (groceries, gas, utilities, mortgage, medicines), and then a list of discretionary expenses (such as movie tickets, dinners out, spa treatments). This may reveal that you can live handily on less than what you currently spend each month.

Next, list your income sources for retirement. They might include Social Security benefits (depending on when you want to claim them), retirement plans, pension checks, dividends, freelance or consulting payments, or other revenue streams. Investment income is also in the mix here, so check with a financial professional to determine a withdrawal rate from those accounts that you can safely maintain through your retirement. (It might differ slightly from the long-recommended 4%.) When you have your list, stack the projected total income up against your essential expenses and see how much you have left over.

Try living off of that level of monthly income for a month or more while you are still working. If it covers your necessary monthly expenses and not much else, then some adjustments in your retirement strategy might be needed – a housing change, a change in your retirement date.

See how it feels to retire. Before you conclude your career, try to arrange some “previews” of your retirement lifestyle. If you want to serve your community, volunteer avidly for a month or two to get a taste of what daily volunteer work is like. If you see yourself traveling enthusiastically at the start of retirement, take a dream vacation or even a couple of consecutive trips (if your schedule allows) to see how they truly fit into your financial picture.

Your “rehearsal” need not be last-minute. If you think you will retire at 65, you could try doing this at 63, 60, or even before then. The earlier your attempt, the more time you have to alter your retirement strategy if needed.

What else should you consider as you rehearse? Besides income, expenses, and the day-to-day retirement experience, there are a few other factors to gauge.

How much cash do you have on hand? Starting retirement with a strong cash position provides you with some insulation if you happen to retire during a market downturn. The possibility of a bear market coinciding with your entry into retirement may make you want to revisit your portfolio allocations as well.

Take a second look at your projected monthly income. Will it be consistent? If it will vary, you will want to address that. If you are in line for a pension, you will face a major, likely irrevocable, financial decision: should it be single life, or joint-and-survivor? The latter option may reduce your pension income in retirement, but give your spouse 50% or more of your pension payments after you die. Your employer might also offer you a lump-sum pension buyout; if that turns out to be the case, you might want to consult with a financial professional who can help you to decide if the lump sum constitutes the better deal versus a lifelong income stream.1

How about your entry into Medicare? You may enroll in it at medicare.gov within a window of your 65th birthday (that is, beginning three months prior to your birthday month and ending three months after it). If you sign up before your birthday, you will be covered beginning on the first day of your birthday month. Sign up following your 65th birthday, and you may have to wait for coverage to begin.2

If you expect to stay on the job after 65, consider signing up for Medicare Part A (the part that pays for hospital care) within the usual window. It will not cost you anything to do so, and sometimes Part A makes up for shortcomings in employer-sponsored health plans. You can enroll in Part B and other Medicare component parts later – within eight months of your retirement, to be precise. You will want to pay attention to that 8-month deadline, as your premiums will jump 10% for every 12-month period afterward that you refrain from enrolling. If you pay for your own insurance, you will still need to enroll in Medicare when you are eligible (Medicare will make that coverage superfluous, so you can anticipate dropping it).3

Rehearsing for retirement can be very insightful. Some new retirees leave work abruptly only to have their financial and lifestyle assumptions jarred. As you want to make a smooth retirement transition to a future that corresponds to your expectations, test-driving your retirement before it begins is only wise.

Erik Brenner, CFP® may be reached at 574.889.7526 or visit our website at www.HilltopWealthTax.com.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

This presentation is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Hilltop Wealth Solutions to be reliable.

Additional information about Hilltop Wealth Solutions is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary Report which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC # 801-115255. Hilltop Wealth Solutions is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Citations.

1 – TheBalance.com, December 13, 2021

2 – Medicare.gov, 2022

3 – CMS.gov, 2022

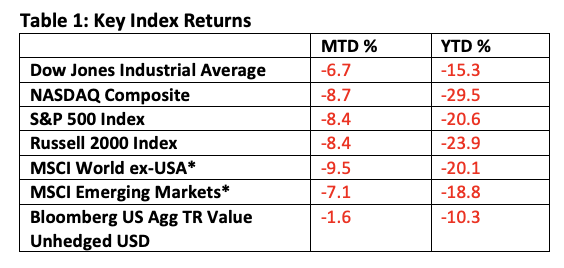

MARKET UPDATE

The Wall Street Journal summed up the first six months of the year with a simple but telling headline: S&P 500 Posts Worst First Half of Year Since 1970.

Morningstar said the Dow’s performance was the worst since 1962.

Source: Wall Street Journal, MSCI.com, MarketWatch, Bloomberg

MTD returns: May 31, 2022—June 30, 2022

YTD returns: Dec 31, 2021—June 30, 2022

*In US dollars

In part, it’s a timing issue since both indexes hit their respective peaks in the first week of 2022.

Timing issues aside, stocks have tumbled since hitting all-time highs, and the S&P 500 Index has shed 23.6% from its January 3 peak to its June 16 trough, which officially lands us in a bear market.

The stock market is considered to be in a bear market when the broad-based index falls 20% from a prior peak.

Since 1957, there have been 13 periods when the S&P 500 has lost 20% or more over six months. That averages out to about one such decline every five years. In other words, it’s not that unusual.

Six of the seven worst sell-offs centered around the 2008 financial crisis, ranging from losses of 29.4% to 42.7%. The outlier occurred in 1974, when the S&P 500 shed 32% over a six-month period.

That 70s show

In 1972, the Consumer Price Index soared from an annual rate of 2.7% in the middle of 1972 to over 12% by the end of 1974, per St. Louis Federal Reserve CPI data.

While the roots of inflation in the 1970s do not mirror what we see today, we do find some similarities, including ultra-easy money in the early 1970s, a lack of fiscal discipline, and soaring oil prices tied to the 1973-74 OPEC oil embargo.

The U.S. is not as dependent on foreign sources today and much greater fuel efficiency mitigates some of the impact, but rising gasoline prices are playing a role in the rise in the CPI, which hit 8.6% in May.

An oil embargo, soaring energy prices, and a sharp rise in interest rates contributed heavily to a recession that began in late 1973 and lasted until early 1975, according to the National Bureau of Economic Research (NBER).

Some commentators believe we are already in a recession. And while there are parallels between then and now, no two periods are exactly alike.

Today, Fed Chief Jerome Powell continues to talk about the importance of getting inflation under control. And the Fed seems to be in no mood to veer from its inflation-fighting course, even if it means a recession.

But a recession is not a foregone conclusion.

Although economic growth has slowed, consumer confidence is down, and a decline in Q2 GDP is on the table, job growth has been robust, layoffs are low (though they have ticked higher), and consumers are splurging on travel and other services that were out of reach in the pandemic.

Final thoughts

We know market pullbacks and bear markets are inevitable, and we recognize they can create unwanted angst. We also know that an unexpected, favorable shift in the economic fundamentals could fuel a sharp rally since sentiment today is quite negative.

As we have seen from over 200 years of stock market history, bear markets inevitably run their course and a new bull market begins.

We saw that after the 2008 financial crisis, and we saw that after the Covid lockdowns led to a swift bear market and a steep but short recession.

We also saw stocks rally from the lows of the 1974 bear market.

We know times like these can be difficult. If you have questions or would like to talk, we are only an email or phone call away.

HILLTOP SPOTLIGHT

NEW TEAM MEMBER

IRA!

She’s tiny enough to fit into the palms of your hands but is a big star at Hilltop Wealth & Tax Solutions. Introducing Ira, the African Pygmy Hedgehog!

Ira loves running at top speeds on her wheel, chomping on bugs, exploring around the office, and sleeping.

The average adult hedgehog has about 3,000–5,000 quills and are controlled by muscles running the length of their back. When a hedgehog feels threatened, they curl into a tight ball and tuck in their heads, tail, and legs, to protect vulnerable parts of their body. However, Ira doesn’t have too many threats to worry about around the office! They are very curious and active, especially at night and can run at a top speed of 9.5 mph and travel a distance of five miles during the night!

Be sure to like our Facebook page to keep up on Ira’s adventures and stop by our Mishawaka office to welcome Ira to the Hilltop team!

HILLTOP TAX SOLUTIONS

Did you know?

Did you know that our seasoned tax professionals can help beyond just preparing and filing your Federal and State Income Tax Returns? If you are in need of bookkeeping or accounting services, Hilltop Tax Solutions offers a flat monthly or quarterly fee to help streamline your business.

CLICK HERE to find out how your family member, friend,

or coworker can get in contact with us!

JULY TRIVIA: As always, please submit your responses to Marla Brenner and those who answer all three questions correctly will be entered into a drawing to win this month’s prize. Good Luck!

- Where do the proceeds go from our dunk tank fundraiser?

- How fast can hedgehogs run?

- What is the Hilltop Hedgehogs name?

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Hilltop Wealth Solutions to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. Reliance upon information in this letter is at the sole discretion of the reader.

VIEW PAST ISSUES OF YOUR WEALTH CONNECTION:

Start the conversation

With no financial incentives, Hilltop helps clients develop a goal-driven plan to do just that.